The Zurich Critical Illness List PDF provides a comprehensive guide to understanding the covered conditions, benefits, and terms of Zurich’s critical illness insurance policies. It details the range of serious health conditions, including cancer, heart-related illnesses, and neurological disorders, ensuring policyholders are well-informed about their coverage options and how claims are processed. This document is essential for anyone considering critical illness insurance to make informed decisions about their financial protection during health crises.

Overview of Zurich Critical Illness Insurance

Zurich Critical Illness Insurance provides financial protection upon diagnosis of serious health conditions, offering a lump sum payment to help cover medical and non-medical expenses. Designed to support individuals during health crises, this insurance is often purchased alongside life insurance. The policy pays out for conditions like cancer, heart attacks, and strokes, providing flexibility in how the funds are used. Zurich’s insurance is valued for its comprehensive coverage and ability to offer peace of mind, ensuring financial security when it’s needed most.

Importance of Understanding the Critical Illness List

Understanding the Zurich Critical Illness List is essential for policyholders to grasp the scope of coverage and ensure clarity on what conditions are included. This list outlines the specific serious health conditions, such as cancer, heart attacks, and strokes, that qualify for a payout. Knowing the details helps individuals make informed decisions about their financial security and prepares them for potential health crises. It also highlights how the insurance can support medical and non-medical expenses, providing peace of mind during challenging times.

Key Features of Zurich Critical Illness Cover

Zurich Critical Illness Cover provides a lump-sum payment upon diagnosis of a covered illness, offering financial support for medical and non-medical expenses, with a range of conditions included.

Lump Sum Payment for Diagnosed Illnesses

Zurich Critical Illness Cover provides a lump-sum payment upon diagnosis of a covered illness, offering immediate financial support. This payment is designed to help cover medical expenses, lifestyle adjustments, or any other needs during recovery. The lump sum is paid directly to the policyholder, ensuring flexibility in how the funds are used. This feature is particularly valuable for maintaining financial stability during a health crisis, without the need to provide ongoing proof of treatment or expenses. It ensures peace of mind when focusing on recovery.

Range of Covered Conditions

Zurich’s Critical Illness List includes a broad spectrum of serious health conditions, ensuring comprehensive coverage for policyholders. The list encompasses major illnesses such as cancer, heart attacks, strokes, and neurological disorders, as well as other severe medical conditions that significantly impact daily life. This extensive range provides a financial safety net, helping individuals and families navigate challenging health situations. The specific conditions and their definitions are detailed in the Zurich Critical Illness List PDF, offering clarity and assurance for those seeking protection against life-altering diagnoses.

Flexibility in Using the Benefit Amount

Zurich’s Critical Illness Cover offers flexibility in utilizing the benefit amount, allowing policyholders to use the lump sum payment as needed. Funds can cover medical expenses, lifestyle adjustments, or even non-medical costs like debt repayment. This flexibility ensures that individuals can address their specific financial and personal needs during a health crisis. Zurich does not impose restrictions on how the benefit is used, providing policyholders with control and peace of mind during challenging times.

Conditions Covered in Zurich Critical Illness List

Zurich’s Critical Illness List includes a wide range of serious health conditions, such as cancer, heart-related illnesses, and neurological disorders. The list is comprehensive, ensuring policyholders receive coverage for life-threatening diagnoses, aligning with the policy’s purpose to provide financial support during health crises.

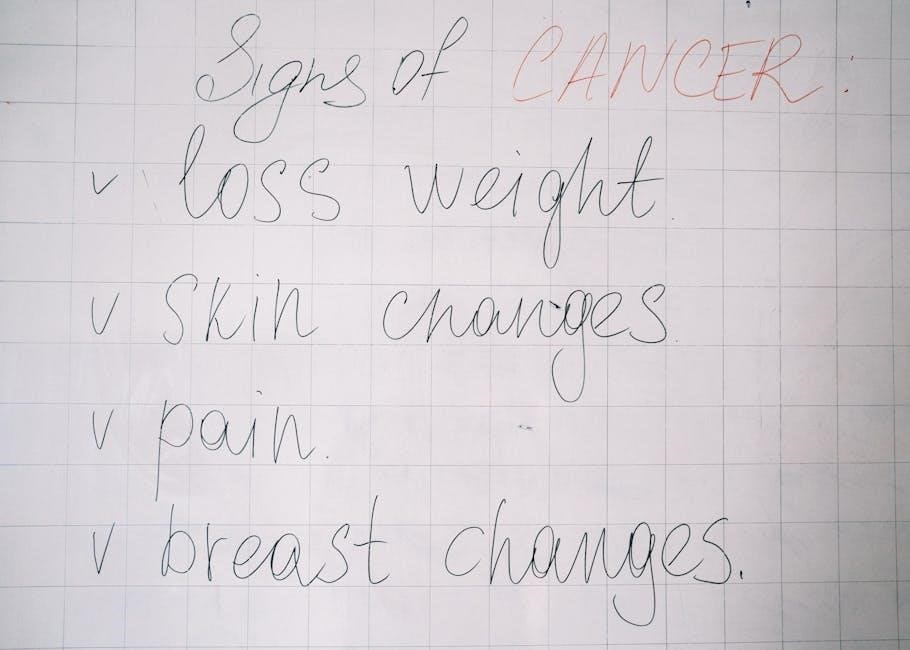

Cancer and Related Conditions

Zurich’s Critical Illness List includes comprehensive coverage for various types of cancer and related conditions. The policy covers diagnoses of invasive cancers, such as breast, lung, and colon cancer, as well as less advanced cases in some scenarios. Related conditions, such as carcinoma in situ and certain cancer-related treatments, may also qualify for partial payments. The list ensures that policyholders receive financial support for medical and non-medical expenses, offering peace of mind during challenging health crises. This coverage is a cornerstone of Zurich’s critical illness insurance, providing substantial benefits for cancer-related claims.

Heart-Related Illnesses

Zurich’s Critical Illness List includes coverage for various heart-related conditions, such as heart attacks, coronary artery bypass grafts, and heart failure. The policy provides a lump sum payment upon diagnosis, offering financial support for medical treatments, rehabilitation, and lifestyle adjustments. This coverage is designed to alleviate the economic burden on policyholders during recovery, ensuring they can focus on their health without additional stress. Heart-related illnesses are a key component of Zurich’s comprehensive critical illness insurance, providing essential protection for cardiovascular health issues.

Neurological Conditions

Zurich’s Critical Illness List includes coverage for severe neurological conditions such as brain injuries due to anoxia or hypoxia, multiple sclerosis, and other debilitating neurological disorders. The policy provides a lump sum payment upon diagnosis, offering financial support for specialized treatments, rehabilitation, and long-term care. This coverage helps alleviate the financial burden on policyholders and their families, enabling them to focus on recovery and maintain their quality of life during challenging times. Neurological conditions are a critical component of Zurich’s comprehensive insurance protection.

Other Serious Health Issues

Zurich’s Critical Illness List also covers other severe health conditions, including Crohn’s disease, heart failure, and benign spinal cord tumors. These conditions, while not always life-threatening, can significantly impact a person’s quality of life and require extensive medical care. The policy provides a lump sum payment upon diagnosis, offering financial support for treatments, medications, and lifestyle adjustments. This coverage ensures that policyholders can manage their health challenges without added financial strain, providing peace of mind during difficult times.

How Zurich Critical Illness Claims Work

Zurich Critical Illness claims provide a lump sum payment upon diagnosis of a covered condition, offering financial support for medical and non-medical expenses during recovery.

Claim Process and Requirements

The Zurich Critical Illness claim process requires policyholders to notify Zurich upon diagnosis of a covered condition. A completed claim form and medical evidence from a certified physician are essential. Zurich reviews the documentation to ensure the condition meets the policy’s criteria. Once approved, the lump sum payment is issued directly to the policyholder. The process is designed to provide timely financial support during recovery, ensuring policyholders can focus on their health without added stress.

Payment Structure and Amounts

Zurich Critical Illness Insurance provides a lump sum payment upon diagnosis of a covered condition, offering financial flexibility during recovery. The payment amount is based on the policy’s coverage level, with no restrictions on how the funds are used. Additionally, certain conditions may qualify for partial payments or enhanced benefits, such as cancer diagnoses or children’s critical illness benefits. The policy also includes a death benefit reduction after a critical illness claim, ensuring some financial protection remains for beneficiaries.

Optional Enhancements to Critical Illness Cover

Zurich offers additional benefits like extra payments for specific conditions, children’s overseas treatment, and enhanced death benefits, providing tailored financial support beyond the standard policy coverage.

Additional Payment Conditions

Zurich’s Critical Illness Insurance includes additional payment conditions to enhance coverage. These may cover specific severe illnesses or scenarios, such as advanced cancer stages or major organ transplants. Policyholders can receive extra benefits, like a lump sum or monthly payments, tailored to their needs. These enhancements provide financial flexibility during recovery, ensuring comprehensive support for medical and non-medical expenses, offering peace of mind during challenging times.

Children’s Critical Illness Benefit

Zurich’s Children’s Critical Illness Benefit provides financial support if a child is diagnosed with a serious illness. This coverage offers a fixed payment to help families cover medical expenses, childcare, or take time off work. It includes conditions like cancer, organ transplants, or other life-threatening illnesses, ensuring parents can focus on their child’s recovery without financial strain. This optional benefit enhances the overall protection offered by Zurich’s critical illness policies, giving families added peace of mind.

Comparison with Other Critical Illness Providers

Zurich’s critical illness insurance stands out for its comprehensive coverage of 40 serious conditions, including cancer, heart attack, and stroke, offering a competitive edge in the market.

Differences in Covered Conditions

Zurich’s critical illness list includes coverage for 40 serious conditions, such as cancer, heart attack, and stroke. While some providers offer broader lists, Zurich focuses on high-impact illnesses. Competitors may cover up to 70 conditions, but Zurich’s approach ensures clarity and relevance. For example, Zurich includes specific neurological conditions like multiple sclerosis and heart-related issues like heart failure. Other providers might exclude certain early-stage cancers or less severe conditions, making Zurich’s list more targeted to severe health crises. This focused approach helps policyholders understand their coverage clearly.

Variations in Policy Terms and Benefits

Zurich’s critical illness insurance offers flexible policy terms, including level, decreasing, or increasing cover options; Benefits vary, with some policies providing a lump sum or monthly payments. Optional enhancements, like additional payment conditions or children’s critical illness benefits, are available. Unlike some competitors, Zurich’s policies may adjust based on inflation or fixed rates. These variations allow policyholders to tailor coverage to their financial needs, ensuring they receive adequate support during health crises without unnecessary expenses.

How to Choose the Right Critical Illness Cover

Assess your financial needs and health risks to select a policy that aligns with your circumstances. Evaluate coverage limits, conditions, and exclusions to ensure comprehensive protection.

Assessing Your Financial Needs

Evaluate your income, savings, and debts to determine how much financial support you would need if diagnosed with a critical illness. Consider your ability to cover medical expenses, daily living costs, and potential lost income. Assess whether the lump sum payment from Zurich’s critical illness cover would suffice to maintain your lifestyle and financial stability during recovery. Ensure the policy aligns with your personal circumstances and provides adequate protection for you and your dependents.

Considering Policy Limitations and Exclusions

Review Zurich’s critical illness policy to understand its limitations and exclusions. Certain conditions, like less advanced cancers or specific neurological disorders, may not be fully covered. Pre-existing illnesses or related health issues might also affect claims. Assess the policy’s terms to ensure it aligns with your health history and financial needs. Understanding these details helps avoid unexpected issues and ensures the cover provides the protection you expect during a health crisis.

Cost Considerations for Zurich Critical Illness Insurance

Premiums vary based on factors like age, health, and policy terms. Balancing coverage levels and affordability is key to ensuring comprehensive protection without financial strain.

Factors Influencing Premium Rates

Premium rates for Zurich Critical Illness Insurance are influenced by age, health conditions, lifestyle, and occupation. Older individuals or those with pre-existing conditions may face higher costs. Policy duration, coverage amount, and the number of dependents also impact premiums. Additionally, lifestyle factors such as smoking or high-risk hobbies can increase rates. Zurich tailors its underwriting to individual circumstances, ensuring fair and accurate terms. Balancing these factors is crucial to secure affordable yet comprehensive protection.

Striking a Balance Between Cost and Coverage

When selecting Zurich Critical Illness Insurance, balancing cost and coverage is essential. Higher coverage amounts offer greater financial security but may increase premiums. Policyholders should assess their financial needs, considering factors like medical expenses and lost income. Optional enhancements, such as additional payment conditions or children’s benefits, can be added to tailor coverage. Carefully evaluating these elements ensures a policy that provides adequate protection without excessive costs, offering peace of mind during unexpected health challenges.

Benefits of Zurich Critical Illness Insurance

Zurich Critical Illness Insurance provides financial security during health crises, offering lump-sum payments to cover medical and non-medical expenses, ensuring peace of mind for policyholders and their families.

Financial Security During Health Crises

Zurich Critical Illness Insurance offers financial stability during health crises by providing a lump-sum payment upon diagnosis of a covered condition. This benefit enables policyholders to cover medical expenses, lost income, and other financial obligations without depleting savings. The flexibility of the payment allows individuals to focus on recovery while maintaining their lifestyle and protecting their family’s future. It ensures peace of mind, alleviating financial stress during challenging times and providing a safety net for unexpected health-related costs.

Support for Medical and Non-Medical Expenses

Zurich Critical Illness Insurance provides a lump sum payment upon diagnosis, offering financial support for both medical and non-medical expenses. Policyholders can use the funds to cover costly treatments, rehabilitation, or home modifications. Additionally, the benefit helps with non-medical costs, such as daily living expenses, mortgage payments, or childcare, ensuring a stable lifestyle during recovery. This flexibility allows individuals to focus on their health without financial strain, providing comprehensive support during challenging times.

Zurich’s Critical Illness List PDF offers a clear, detailed overview of covered conditions and benefits, providing policyholders with essential insights to secure their financial well-being during health crises.

Final Thoughts on Zurich Critical Illness Cover

Zurich’s Critical Illness Cover is a valuable asset for individuals seeking financial security during serious health crises. It provides a lump sum payment upon diagnosis of covered conditions, such as cancer, heart attacks, and strokes, offering flexibility to address medical and non-medical expenses. With optional enhancements like additional payment conditions and children’s benefits, Zurich’s policy stands out for its comprehensive coverage and tailored protection. This insurance ensures peace of mind, helping policyholders focus on recovery without financial strain, making it a wise choice for safeguarding one’s future.